In October, private-sector job creation experienced a rebound, reflecting a labor market snapshot that has garnered increased attention due to the lack of official federal employment statistics. Payroll processing company ADP on Wednesday estimated that private-sector businesses added approximately 42,000 jobs last month, marking a return to positive territory following consecutive months of job losses. October saw a rebound in job growth; however, the chief economist at ADP warned that the hiring rate is significantly lagging compared to earlier in the year and is increasingly concentrated within a limited number of sectors. “That recovery is tepid, and it is not broad-based,” stated Nela Richardson on Wednesday. Reports says that the most significant job increases were observed in sectors including trade, transportation, and utilities, which added 47,000 jobs; education and health services, which saw an increase of 26,000 jobs; and financial activities, which contributed an additional 11,000 jobs.

The sectors experiencing the most significant job reductions included information, with a decline of 17,000 positions; professional and business services, which saw a decrease of 15,000 jobs; and leisure and hospitality, which lost 6,000 jobs. “The most concerning trend would be that drop in leisure and hospitality, because that points swiftly back to the consumer and how healthy and resilient the consumer will be,” Richardson stated. “In the last three months of the year, consumer resiliency has driven employment growth in that sector, making this negative number a point of concern as we approach the holiday season.” Richardson highlighted that the hiring softness observed among small businesses may serve as an additional troubling indicator regarding the economy’s health, emphasizing the significant role these smaller firms play in overall employment levels.

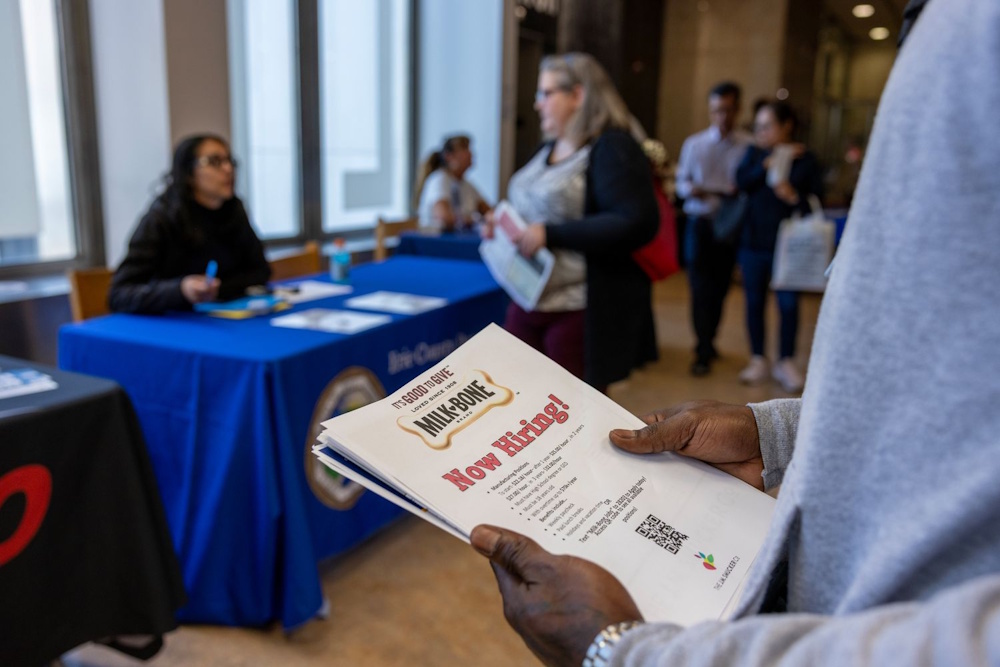

ADP’s monthly report indicates a notable deceleration in the labor market since the summer, reflecting net job losses for both September and August. Revisions published on Wednesday indicated that the number of jobs lost in September was lower than the initial estimates provided by ADP. September’s job losses are currently recorded at 29,000, compared to an anticipated loss of 32,000, while August saw a reduction of 3,000 positions. Nevertheless, a recovery was anticipated for October. Last week, ADP introduced a weekly “pulse” report detailing employment estimates. The report indicated that private employers contributed an average of 14,250 jobs per week over the four-week period concluding on October 11. Wednesday’s job gains exceeded the anticipated 37,500 jobs added, as reported by FactSet. The pulse report was initiated to “meet the moment,” as Richardson indicated, highlighting the federal government shutdown’s consequent void in employment and other data. ADP’s estimates have consistently served as a proxy for the official monthly jobs report, which is usually published two days later; however, the correlation between the two sets of figures is not always reliable. However, in the absence of a jobs report last month and with no expectations for one this month due to the shutdown, ADP’s data has assumed a significant role for economists and investors aiming to assess the health of the economy.

Federal Reserve Chair Jerome Powell indicated last week that the absence of government data is “clouding” the central bank’s perspective on economic activity and that a decision regarding a rate cut next month is not a “foregone conclusion. If you’re driving in the fog, you slow down,” Powell remarked during a press conference after the October rate-setting committee meeting. “We are obligated to fulfill our responsibilities regardless of the circumstances.” He added that by the December meeting, the Fed anticipates a more robust flow of data. The Fed executed a quarter-point rate reduction last week to bolster a weakening labor market; however, Fed Governor Lisa Cook indicated this week that she perceives a greater necessity for the central bank to prioritize persistent inflation over unemployment concerns. The most recent Consumer Price Index report indicated that annual inflation hit 3% last month, marking the highest level since January. The latest jobs report indicated that unemployment rose to 4.3% in August, with the economy adding a mere 22,000 jobs during that month. For the first time in several years, the labor market is characterized by a shortage of jobs relative to the number of individuals seeking employment, with approximately 7.2 million open positions juxtaposed against around 7.4 million unemployed individuals.