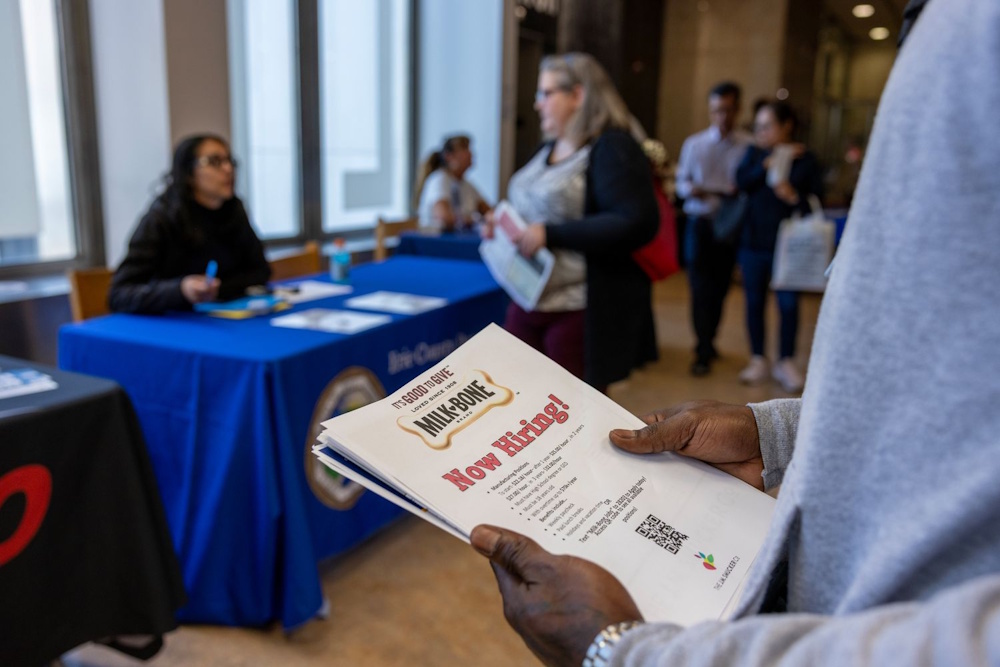

In a K-shaped economy where the “have-nots” are increasingly falling behind the “haves,” the labor market is exhibiting a parallel trajectory. In October, job opportunities did not decline as anticipated, with holiday staffing requirements contributing to an increase in openings, reaching a five-month peak, according to newly released data that had been delayed due to shutdowns. However, the most recent official assessment of employment trends indicated that a significant chill persists within the US economy. Hiring remained stagnant, layoff activity increased, and employees held onto their positions with great apprehension: The voluntary quits rate, an important measure of worker confidence, has declined to a five-year low, as reported. “The labor market is becoming a much more exclusive club,” stated Noah Yosif. “Individuals within the inner circle are faring quite well; however, for those on the periphery, the barriers to entry are increasingly formidable. And if that is to continue in the long term, the inability for those individuals on the outside to secure a steady paycheck could lead to more severe ramifications for the economy,” he added.

Tuesday’s report, encompassing September and October JOLTS data, represents the most recent entry in a series of federal economic reports that faced delays and disruptions due to the significant impact of the historic federal shutdown on the capacity of statistical agencies to collect, process, analyze, and disseminate essential data. The initial labor market release for October from the BLS provides the latest official insight into the job market, crucial for Federal Reserve policymakers as they convene to deliberate their forthcoming decisions regarding interest rates. A policy announcement is scheduled for 2 p.m. on Wednesday. The JOLTS report from the BLS serves as a significant measure of labor turnover, illustrating the dynamics of business hiring intentions (openings), actual workforce additions (hires), reductions in workforce (layoffs), and the rate at which employees voluntarily exit their positions (quits). The churn is essential for maintaining a robust labor market and, by extension, a thriving economy. “The labor market depends on dynamism,” Yosif stated. “The dynamism of the labor market fundamentally influences the ability of employers to identify the most suitable candidates for their positions, while simultaneously affecting employees’ capacity to discover optimal opportunities and secure a reliable income that contributes to economic growth.” However, throughout much of this year, the US labor market has experienced a decline in momentum. Despite the elevated tally of estimated job openings reported on Tuesday, this trend persisted in September and October. Upon the release of the August JOLTS report, just prior to the onset of what would ultimately be the longest shutdown on record, the proportion of job openings relative to total employment was observed to be at a five-year low.

September witnessed a robust recovery, as indicated by Tuesday’s data, with the count of available jobs increasing from 7.23 million in August to 7.66 million. In October, they increased to 7.67 million. Nonetheless, the heightened number of job openings seems to be predominantly influenced by companies preparing for the upcoming holiday shopping period: In October, the trade industries, encompassing wholesale, retail, and transportation, experienced the most significant increases in job postings, as indicated by JOLTS data. The hiring outlook appeared increasingly bleak, with a limited number of industries contributing to job growth. With the exception of a slight increase in certain services firms, employment levels remained stagnant or declined across the majority of sectors. “Where employers truly demonstrate their commitment is in the hiring process,” Yosif stated. “Regrettably, there has not been a significant increase in hiring.” The estimated level of hires and the rate of hiring, expressed as a percentage of total employment, experienced an uptick in September compared to August; nonetheless, both metrics declined once more in October. The hiring rate has reverted to one of its lowest levels observed in over a decade, according to BLS data. To external observers, that is disheartening information. “There’s no holiday cheer for job seekers,” Heather Long stated on Tuesday. “Although it is positive that job openings increased in October, one must remain cautious until companies begin to hire individuals.” In September and October, layoffs rose, reaching their peak since January 2023. Nevertheless, the rate of layoffs is approximately at the level observed prior to the pandemic. As the job market experiences stagnation, the availability of opportunities diminishes. In the current labor market characterized by low hiring and low firing, jobseekers are experiencing an average duration of six months to secure employment, as indicated by Tuesday’s report, which reveals that those currently employed are clinging to their positions.

Quits declined to their lowest levels since May 2020, a period marked by significant economic disruption due to the pandemic. Currently, the US economy appears capable of enduring the declining momentum in the jobs market, as Yosif pointed out, highlighting a change in the “breakeven rate” of employment. “Back in 2023, the breakeven rate for the economy was about 250,000 jobs every month, but now that’s dropped to about [30,000] to 40,000 jobs per month,” he stated, emphasizing that the year-to-date job gains significantly exceed that breakeven threshold. However, he cautioned that the more pressing inquiry revolves around, “Who is having access to these opportunities.” “The stagnant labor market is significantly affecting the young and financially vulnerable workers,” he stated. “The economy can certainly endure this absence of momentum for an extended period; however, it is the individuals adversely affected by the stagnant labor market whose repercussions will be experienced more intensely.” The morning of December 16 will provide a more definitive overview of employment trends, as the BLS is set to publish the November jobs report. The release, delayed due to the shutdown, will also encompass partial data for October, including payroll estimates, while excluding survey-derived metrics such as the unemployment rate or demographic information.